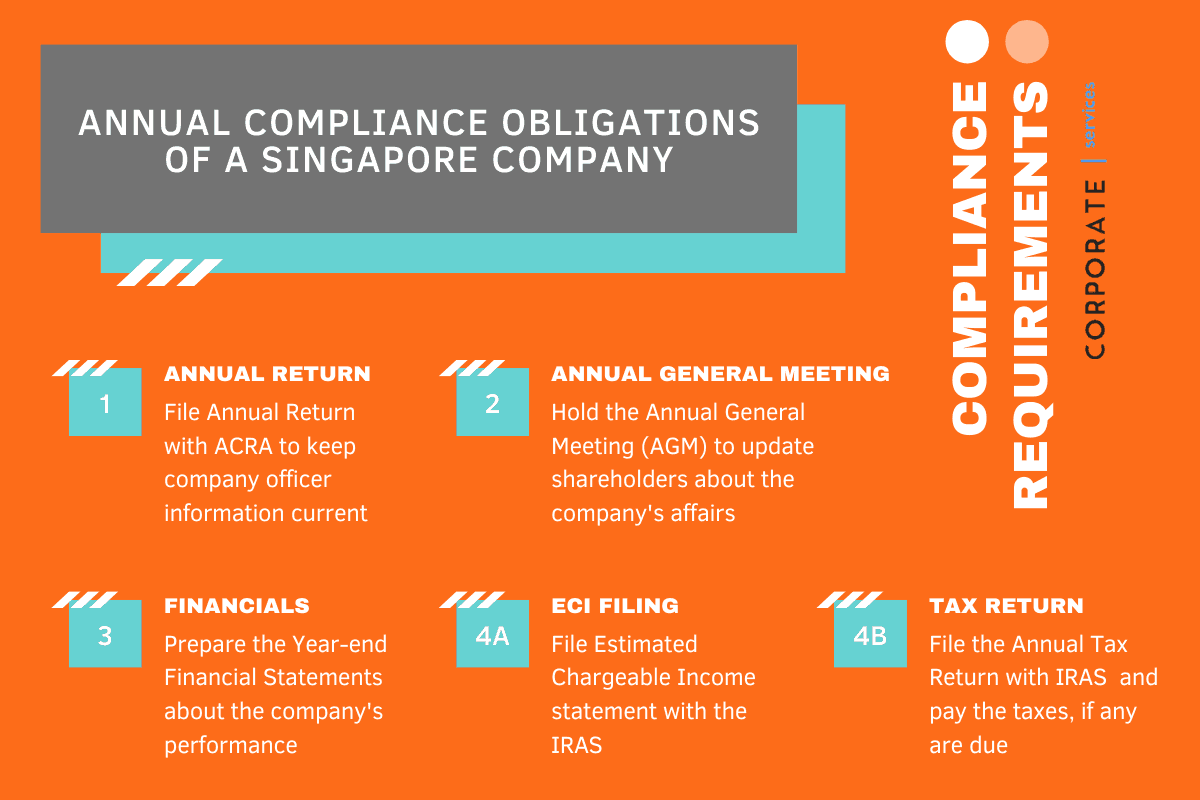

Singapore Company Annual Filing Requirements

According to the Singapore Companies Act, every Singapore company must file certain reports to relevant government bodies each year. These annual compliance requirements are mandatory and consist of the following:

- Annual Financial Statements

- Annual General Meeting (AGM)

- Annual Return (AR) Filing with ACRA

- Annual Tax Return Filing with IRAS

The sections below provide detailed information about each one of these requirements. If you are planning to register a new Singapore company or need to file annual reports for your existing company, see our special offer.

Annual Return (AR) Filing with ACRA

ACRA (Accounting and Corporate Regulatory Authority of Singapore) is a government body that oversees and enforces company regulations in Singapore. The Singapore Companies Act requires all companies to file an Annual Return with ACRA within 30 days of holding an AGM. The Annual Return is filed using BizFile, ACRA’s online filing system.

What is an Annual Return?

An Annual Return is a set of documents containing up-to-date information on:

- Company name and registration number

- Principal activities

- Registered office address

- Details of company officers (directors, secretary)

- Shareholder details, share capital, etc.

- Annual financial statements

Exemption From Attaching Financial Statements

Certain companies are exempt from having to attach their financial statements in the Annual Return; these include:

- Small companies: As a reminder, small companies are companies that meet 2 of the 3 following criteria in the immediate two preceding financial years:

- Total annual revenue is less than S$10 million

- Total assets are less than S$10 million

- A maximum of 50 employees

- Exempt private companies (EPC): An EPC is a company with:

- No more than 20 shareholders

- No corporate shareholders (i.e., all the shareholders are natural persons)

- Dormant EPC: A dormant EPC is defined as a company that has not carried on any business nor generated any income in the past financial year.

XBRL Format for Financial Statements

Since 2014, the Singapore government has required companies to file their financial statements in eXtensible Business Reporting Language (XBRL). XBRL format is an XML-based format for financial documents that businesses use to exchange financial information. The format is open source and free to use.

Certain companies are exempt from preparing financial statements in XBRL, including:

- Foreign companies and their branches

- Companies limited by guarantee

- Companies permitted to prepare financial statements in accordance with accounting standards other than SFRS, SFRS for Small Entities, and IFRS

- Solvent Exempt Private Companies (EPC): An EPC a company with:

- No more than 20 shareholders

- No corporate shareholders (ie all the shareholders are natural persons)

Annual Return Filing Without Holding an AGM

In certain cases, ACRA allows companies to apply to file annual returns without holding an AGM. Companies must apply through BizFile. ACRA can still reject the application, especially if a company has applied more than once. If the application is accepted, ACRA generally will notify the company within 14 days.

A company that files its annual return late with ACRA will be required to pay an additional late lodgment fee. The late fee increases as the number of days in default increases.

Annual General Meeting (AGM)

The Singapore Companies Act requires companies to hold Annual General Meetings (AGM) of their shareholders unless the company has chosen not to hold AGMs by passing a shareholders resolution. If the company chooses not to hold AGM, all matters which are to be dealt with at the AGM can be settled through the passing of written resolutions.

What is an AGM?

An AGM is a shareholders’ meeting every calendar year at specified intervals. This meeting gives the company’s shareholders the right to participate in certain decisions of the company which requires their approval. One of the primary purposes of the AGM is to consider the company’s financial statements, which shareholders must approve on the basis of simple majority.

AGM Timeline

| For companies with FYE ending before August 31, 2018 | For Companies with FYE ending on or after August 31, 2018 |

|---|---|

| For listed companies: Hold AGM within 4 months after FYE. For any other company: Hold AGM within 6 months after FYE. |

According to section 175 of the Companies Act, a company and any directors who fail to hold an AGM can face a fine of up to S$5,000. However, to avoid prosecution, ACRA allows companies and directors to pay a composition fee of S$300 for each breach.

Annual Financial Statements

Under the Singapore Companies Act, all companies incorporated in Singapore and all Singapore branches of foreign companies are required to prepare and present financial statements that comply with the Singapore Financial Reporting Standards (SFRS). SFRS is principally based on and substantially similar to the International Financial Reporting Standards (IFRS) that are issued by the International Accounting Standards Board (IASB).

Key Facts

- Financial statements cannot be prepared more than 6 months prior to the date of an AGM

- The company director must sign the financial statements to take responsibility for their accuracy and preparation in accordance with Singapore accounting standards

- Small and dormant companies that meet certain criteria can prepare unaudited financial statements

Financial Statements

The financial statements that must be prepared are as follows:

- Report of Directors and Statement by Directors

- Independent Auditor's Report (if applicable)

- Statement of Comprehensive Income (Profit and Loss statement)

- Statement of Financial Position (Balance sheet)

- Cash Flow Statement

- Statement of Shareholder’s Equity

- Corresponding Notes to Financial Statements

Audit Exemption

To ease the burden of filing, Singapore exempts certain companies from having their financial statements audited; these include:

- Small companies: A small company is any company that meets 2 of the 3 following criteria:

- Total annual revenue is less than S$10 million

- Total assets are less than S$10 million

- Maximum of 50 employees

- Dormant companies: A dormant company is any company that has not carried on business and has not generated any income in the past tax year.

Such companies can prepare unaudited financial statements.

Annual Tax Return Filing with IRAS

IRAS (Inland Revenue Authority of Singapore) is the government agency responsible for collecting taxes in Singapore. All Singapore companies are required to file annual tax returns with IRAS.

Annual tax returns include two filings:

- Estimated Chargeable Income that must be filed within 3 months of the company’s financial year-end

- Corporate income tax return that must be filed by November 30 for paper filing or by December 15 for electronic filing

Filing Estimated Chargeable Income (ECI)

ECI is an estimate of a company's taxable income for the latest financial year that ended.

IRAS requires companies to file ECI within 3 months after the financial year end. Companies will receive a reminder from IRAS to file ECI in the last month of the financial year.

As of July 2017, the following companies are not required to file ECI:

- Companies with less than S$5 million in annual revenue

- Companies whose ECI is NIL

Filing Corporate Income Tax Return

In addition to filing ECI, companies must file an annual income tax return using form C or C-S albeit at a later date. Currently, there are two deadlines to file a corporate income tax return with IRAS:

- November 30 for paper filing

- December 15 for e-filing

Note that these dates for filing a corporate income tax return are the dates of the year following the year of the financial year end. For example, if the financial year ended on March 31, 2017, the corporate income tax return must be filed by November 30 or December 15 of 2018.

Companies that file with form C must also attach tax computations, financial statements, detailed profit & loss statement, and other supporting documents.

Form C-S is a simplified version of the corporate tax return that does not require companies to attach tax computations and financial statements. To file using a C-S form, companies must meet all of the following requirements:

- The company must be incorporated in Singapore

- The company must not make more than $5 million in annual revenue

- The company is not claiming any of the following:

- Carry-back of current year capital allowances/losses

- Group relief

- Investment allowance

- Foreign tax credit and tax deducted at source

Tax Filing for Dormant Companies

In generally, dormant companies are still required to file a corporate tax return with IRAS, although IRAS allows for certain exceptions. Dormant companies can apply for a waiver to submit tax returns if they meet the following conditions:

- The company has not conducted business or generated any income

- The company has submitted either its Form C-S or Form C, financial statements and tax computations up to the date of stopping business activity

- The company must not own any investments (e.g. shares, real properties, fixed deposits). If the company owns investments, it must not derive any income from these investments

- The company must have been deregistered for goods and services tax (GST) purposes

- The company must not have the intention to recommence business within the next 2 years

IRAS normally will process the waiver within 2 months.

Non-Compliance With IRAS

ECI non-compliance

- Failure to submit the ECI within three months from the end of its financial year

- Failure to meet the conditions to be exempted from submitting ECI

If a company fails to comply with ECI requirements, IRAS will send the company a Notice of Assessment (NOA) that provides an estimation of the company’s income. To avoid late penalties or further enforcement action, the company is required to pay the estimated income to IRAS within 1 month, even if the company does not agree with IRAS' estimated assessment.

If the company does not agree with IRAS’ assessment, it can send a Notice of Objection. The Notice of Objection must include the reasons for filing ECI late (or failure to file ECI, as the case may be) and the new estimated ECI.

Note, when sending a Notice of Objection, the company is still required to pay taxes on the ECI within 1 month.

Corporate income tax non-compliance

- Failure to file a corporate income tax return

- Failure to file a form C or form C-S by the required due date

In most cases, a company can avoid penalties by simply filing its income tax return. However, failure to file corporate taxes may play out in four phases with each phase resulting in escalated consequences.

Phase 1: IRAS may issue an estimated Notice of Assessment (NOA). Once the NOA is received, the company is required to pay the estimated tax provided on the NOA within 1 month. Along with paying the estimated tax, the company should file its income taxes.

The company can file a Notice of Objection with the IRAS if it believes IRAS’ assessment was incorrect. Once the company has paid the estimation and filed its income taxes, its tax obligations are fulfilled for the year.

Phase 2: IRAS will issue an Outstanding Tax Return Notice and assess a composition fee of up to S$1,000. The company should file its income tax return and pay the composition fee. The company can appeal to have the composition fee waived, although most fees are upheld.

Phase 3: IRAS will issue a Notice of a Section 65B(3) of the Income Tax Act to the director and a composition fee of up to S$1,000. To avoid further penalties, the director must provide all the documents requested in the Notice of a Section 65B(3) and pay the composition fee with 21 days.

Phase 4: IRAS will issue to the director a Summons to appear in court. To avoid going to court, the director must submit the requested document from the Summons and pay the summons fee at least one week before the court date.

If the director is unable to submit the required documents and pay the summons fee, she will be required to attend court. In court, the director will be fined up to S$1,000 and the company will still be required to file an income tax return.

Phase 5: Failure to file for more than 2 years. If a company still has not filed its income tax return after 2 years, the company can face the following consequences:

- A penalty that is twice the amount of tax

- A fine of up to $1,000.

Streamlining the Filing of Annual Returns

Filing annual returns in Singapore involves preparing financial statements, coordinating and holding annual general meetings and submitting the right filings in the permitted timeframe to both ACRA and IRAS.

Failure to meet any of the requirements can lead to serious consequences for a company. That is why most companies in Singapore choose to rely on an experienced corporate service provider who can offer expert guidance through each step of the annual filing process and ensure that the company is in compliance with Singapore regulations.

Why Singapore

Recently, CorporateServices.com conducted a survey of startup founders from five countries. To assess global sentiment about Singapore’s attractiveness as a startup location, the survey assessed Singapore on metrics considered important by entrepreneurs. Read our report for more details.

Related Topics

Our team of experts can deliver all corporate services on a world-class platform at very affordable prices — the best of all worlds.