Singapore Corporate Tax Rate, Exemptions, Filing Requirements - Complete Guide

One of the major draws to incorporating a company in Singapore is the country’s low corporate tax rate. This article covers the following aspects of the Singapore corporate tax rate:

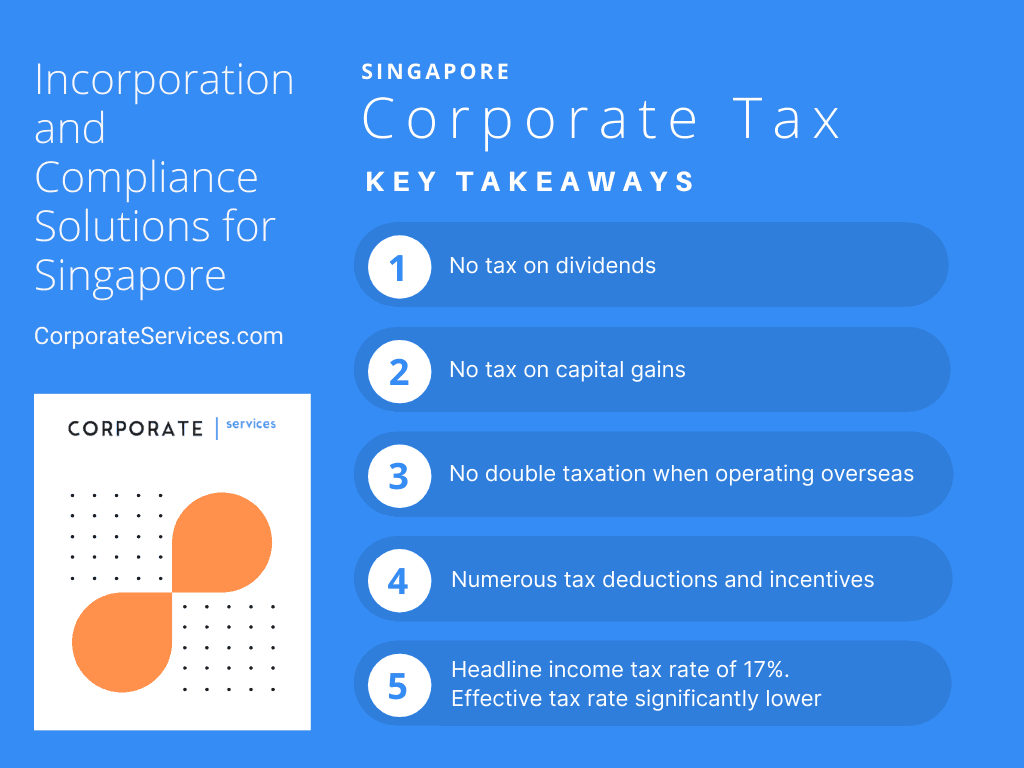

Key Facts About Corporate Tax - Singapore

- Singapore levies taxes on profits and not on revenue. Profits of your Singapore company will be taxed at 17% (with an effective tax rate often lower due to various tax incentives and tax exemptions available to Singapore-resident companies).

- Singapore uses a territorial tax system. Where income is earned from treaty countries, double taxation is avoided by means of a foreign tax credit granted under those treaties. For non-treaty countries, a unilateral tax credit is given in respect of foreign tax on all foreign-sourced income. Singapore has over 80 tax treaties with other countries to avoid double-taxation of income.

- Singapore uses a single-tier tax system. Companies only pay taxes on profits. Post-tax profit distribution (i.e. dividends) to shareholders is tax-free.

- There is no capital gains tax in Singapore.

- Singapore offers generous incentives and tax breaks when investing in new and promising industries, R&D, and productivity-enhancing technologies.

- Certain types of foreign-source income are exempt from taxation in Singapore.

Want to talk to an expert about starting a business in Singapore? Contact us today!

Singapore Corporate Tax Rate

Singapore’s current headline tax rate is capped at 17%. However, with the tax exemption and incentive programs offered by the Singapore government, the effective Singapore corporate tax rate can be significantly lower.

Current Singapore Corporate Tax Rate

| Type of corporate tax | Tax rate % |

|---|---|

| Corporate profits tax rate | 17% |

| Capital gains tax rate by the company | 0% |

| Dividends distributed to shareholders tax rate | 0% |

| Foreign-sourced income that was already subjected to taxation overseas tax rate overseas | 0% |

Recently, CorporateServices.com conducted a survey of startup founders from five countries. To assess global sentiment about Singapore’s attractiveness as a startup location, the survey assessed Singapore on metrics considered important by entrepreneurs. Read our report for more details.

Taxable Income

Under Singapore’s territorial tax system, qualifying income generated in Singapore and income remitted to Singapore from a foreign source is taxable. In Singapore, taxable income includes:

- Gains or profits from any trade or business

- Income from an investment such as interest and rental property income

- Royalties, premiums and any other profits from property and

- Other gains that are considered revenue

Singapore's tax system also benefits companies by clearly distinguishing between tax deductible and non-deductible business expenses. This structure simplifies tax management and encourages business spending on productive activities, enhancing Singapore's attractiveness as a business hub.

For individuals, check out our article about Singapore Personal Income Tax Rates.

Tax Residency

A company incorporated in Singapore is not automatically considered a tax resident of Singapore.

To be considered a tax resident of Singapore, a company must be controlled and managed from Singapore. According to IRAS, controlled and managed refers to, “making decisions on strategic matters, such as those on company policy and strategy.”

In general, the location of board meetings is a key factor in determining where a company is controlled and managed. Furthermore, the location of company personnel who have a key role in the company’s decision making can also determine tax residency.

Typically, a company is deemed to be a non-resident if board meetings and key management personnel are located outside of Singapore--even if the day-to-day operations of the company are in Singapore.

For example, foreign-based holding companies that only earn passive income are normally considered non-residents since these companies are run with instructions from owners and shareholders who are based outside Singapore.

Note that the tax residency of a company can change from year to year.

The Benefits of Being a Singapore Tax Resident

Companies with Singapore tax residency enjoy the following benefits:

- Tax benefits provided under Avoidance of Double Taxation Agreements (DTAs)

- Tax exemption on foreign-sourced dividends, foreign branch profits, and foreign-sourced service income

- Tax exemption for new startups

Tax Incentives

Companies that are tax resident in Singapore are eligible for the following tax exemption schemes:

Tax Exemption for New Startups

To help local companies grow, Singapore introduced the new startup company scheme in 2005 which provides tax exemption on some of the income of a startup. Under the scheme, new companies that meet the qualifying criteria below receive the following tax exemption for the first three consecutive YAs depending on where the YA falls:

YA 2020 Onwards

New companies that qualify are given a 75% tax exemption on the first S$100,000 of taxable income and an additional 50% exemption on the next S$100,000 of taxable income.

YA 2010 to YA 2019

New companies that qualify are given a full i.e. 100% tax exemption on the first S$100,000 of taxable income and an additional 50% exemption on the next S$200,000 of taxable income.

Qualifying Criteria

The above tax exemption is open to all new companies that meet the following criteria:

- The company must be incorporated in Singapore

- The company must be a tax resident in Singapore

- The company must not have more than 20 shareholders where:

- all of the shareholders are individuals "beneficially and directly" holding the shares in their own names OR

- at least one shareholder is an individual "beneficially and directly" holding at least 10% of the issued ordinary shares of the company.

Note that certain companies are not permitted to use the tax scheme, including:

- Companies whose principal activity is investment-holding

- Companies whose principal activity is the development of property for sale, investment, or both.

Partial Tax Exemption (PTE) Scheme for Companies

All companies qualify for PTE unless the company already claims under the tax exemption scheme for new startups. Under PTE, companies enjoy the following exemptions.

- 75% tax exemption on the first S$10,000 of normal chargeable income and

- A 50% tax exemption on the next S$190,000 of normal chargeable income

In practical terms, this means that the initial S$200,000 of net profit is subject to a corporate tax rate of 9-10%. Profits exceeding S$200,000 are taxed at the standard rate of 17%.

Tax Exemption for Foreign-Sourced Income

Certain types of foreign sourced income are tax exempt; these include:

- Foreign-sourced dividends

- Foreign branch profits

- Foreign-sourced service income

To qualify as tax-exempt, foreign-sourced income remitted to Singapore must meet all three of the following conditions:

- The headline tax rate of the foreign jurisdiction is at least 15% at the time the foreign income is received in Singapore

- The foreign income was taxed in the foreign jurisdiction (note, the rate at which the foreign income was taxed can be different from the headline tax rate)

- The Singapore government is satisfied that the tax exemption would be beneficial to the person resident in Singapore

Other Tax Incentives

The following tax incentive schemes are available to further reduce a company's taxable income if the company meets the criteria defined below.

Development and Expansion Incentive (DEI): DEI is available to companies that are planning to increase or upgrade their operations in Singapore or expand into globally leading industries. Under DEI, all income earned from qualifying activities is either tax-exempt or taxed at a rate of 10% for a period of 5 years.

Companies are required to meet certain criteria to qualify:

- New job creation that adds new skills, expertise and seniority to the Singapore workforce

- Total business expenditure that adds to the Singapore economy

- Commitment to adding new capabilities in terms of new technology, skill sets, and knowhow

Productivity and Innovation Credit (PIC) Scheme: PIC offers companies a 400% tax deduction or allowance on certain expenditures incurred in any of the following six qualifying activities:

- Training employees

- Acquiring and licensing intellectual property rights

- Registering patents, trademarks, designs, and plant varieties

- R&D activities

- Design projects approved by DesignSingapore Council

Investment allowance: Under an investment allowance, companies can receive a tax credit of up to 100% of the capital expenditures incurred for qualified projects during a tax year. Normally, Singapore permits the investment allowance for a period of 5 years; however, certain cases can extend up to 8 years. The types of projects that qualify for an investment allowance include:

- Manufacturing new products or increasing production of an existing product

- Projects requiring specialized engineering or technical services

- Projects focused on R&D

- Construction operations

- Projects to reduce water consumption

- Projects that promote the tourist industry in Singapore (other than a hotel)

- Operations involving space satellites

- Maintenance, repair and overhaul services to any aircraft

- Projects that improve energy efficiency

Tax Return Filing

To complete corporate tax returns, a company must submit two filings with IRAS (Inland Revenue Authority of Singapore):

- Estimated Chargeable Income (ECI): ECI is a company’s taxable income after deducting tax-allowable expenses.

- Form C or Form C-S: In both Form C or Form C-S a company declares its actual income for the tax year. A Form C filing requires companies to attach a Singapore tax computation, financial statements, detailed profit & loss statement, and other supporting documents. Conversely, form C-S is a simplified filing that does not require additional documents.

Due Dates for Tax Return Filing

- ECI: Due within 3 months of the company’s financial year-end

- Form C or form C-S: Due by November 30 for paper filing or December 15 for electronic filing

For more detailed information on tax return filings with IRAS, consult our guide on annual return filing in Singapore.

Singapore Tax Computation and the Basis Period and Year of Assessment (YA)

It is important to understand the concept of the Year of Assessment (or YA) and Basis Period to appreciate the Singapore tax computation. A company is taxed on the income earned in the preceding financial year. This means that income earned in the financial year 2018 will be taxed in 2019. In this example, 2019 is the Year of Assessment (YA). Thus, the YA is the year in which your income is assessed to tax. To assess the amount of tax, IRAS looks at the income, expenses, etc. during the financial year. This financial year is known as the "basis period". The basis period is generally a 12-month period preceding the YA. So, if a company's Financial year end is on March 31 of each year then for YA 2019 its Basis Period will be 1 April 2017 to 31 March 2018.

Tax Treaties

To decrease the tax burden on companies that receive income from foreign sources, Singapore has signed Avoidance of Double Taxation Agreements (DTAs or DTAAs) with over 80 jurisdictions - including major economies in the Americas, Europe, and Asia. The DTAs reduce or eliminate taxes on foreign income that has already been taxed in a foreign jurisdiction. Additional information about a number of these agreements can also be found on www.corporateservices.com (e.g. the India Singapore DTAA / DTA, the Singapore Australia DTA / DTAA, the UK Singapore DTA / DTAA, the Malaysia-Singapore DTA/DTAA etc…).

In some situations, a tax credit may also be available. If the foreign tax was paid in accordance with the DTA provisions then the lower of a) the foreign tax paid and b) the Singapore tax that would have been payable on the same income is calculated. If the company has paid any excess tax in a foreign country then this calculated amount can be claimed as a tax credit in Singapore, known as Double Taxation Relief (DTR). Under DTR, a company can claim some of the foreign income taxes that it has paid against its Singapore income taxes and receive that money back from IRAS.

Furthermore, since 2008, the Singapore government has offered a unilateral tax credit to companies with foreign income sourced from a jurisdiction without a DTA with Singapore.

Note, to receive a foreign tax credit, companies must meet the following requirements:

- The company is a tax resident in Singapore for the relevant basis year

- The tax has been paid or is payable on the same income in the foreign jurisdiction and

- The income is subject to taxation in Singapore

Summary

Singapore is one of the most favorable tax jurisdictions in the world. With a low headline tax rate and generous tax exemption and incentives, companies in Singapore can greatly reduce tax expenses. Furthermore, the tax exemption on capital gains and dividends ensures that shareholders benefit more from their investments.

Finally, the Singapore government's effort to sign Avoidance of Double Taxation Agreements has made it possible to register a company in Singapore and expand internationally without the burden of paying extra taxes on foreign-sourced income.

Frequently Asked Questions

Featured Client

Consistently Competent

I want to acknowledge the great service I have received so far and say that your team has excellent expertise in corporate services for Singapore. You offer exactly what we were looking for — the right balance of reasonable prices and first-class service. Your online CSP system makes the whole experience very smooth and guides our team through easy-to-follow steps for every task. I would definitely recommend your services to anyone who plans to set up a company in Singapore.