Convincing Reasons to Set Up a Singapore Holding Company

Some of the most well-known businesses in the world operate under a holding company structure. Before considering if you should set up a Singapore holding company, it’s important to understand what exactly a holding company is and why it’s particularly valuable in Singapore.

Read more to learn the benefits and the challenges of establishing a holding company structure in Singapore and if it makes sense for your business. Or if you’d like personalized support setting up a Singapore holding company or determining if a holding company structure is right for your business, click “Contact Us” below.

Topics Covered in the Article

What Is a Singapore Holding Company?

In general, a holding company is a company that does not conduct business, but it owns an interest (controlling or non-controlling) in another company or in multiple companies. A holding company can also own assets such as property, patents, trademarks, stocks, artwork, etc. At the same time, all operations are performed by the subsidiary companies that it owns.

If a holding company fully owns another business, the second business is often referred to as its "wholly owned subsidiary." The holding company is often referred to as the "parent" or the "umbrella" company.

A holding company that’s registered in Singapore is considered a Singapore holding company. The subsidiaries and assets owned by a Singapore holding company can reside in Singapore or anywhere else in the world.

What Is an Operating Company?

Holding Company Quick Facts

- A holding company can be structured in a variety of forms. It can be a limited liability company, a limited partnership, a trust, or a foundation. The most widely used holding company structure is a limited liability company.

- The holding company often exercises strong control over its subsidiaries through its participation in (or control of) the board of the subsidiary. However, the holding company does not typically manage the day-to-day operations of a subsidiary.

- The holding company is insulated from the liabilities of the subsidiary. Loss insulation is a key attraction of a Singapore holding company structure.

- The parent can coordinate and pool the resources of its subsidiaries. If a subsidiary does well, the parent benefits, but if the subsidiary performs poorly, the parent is not punished beyond the loss of the parent's original investment in the subsidiary.

The World’s Top Businesses Choose Holding Structures

Singapore Holding Company Examples

Johnson & Johnson

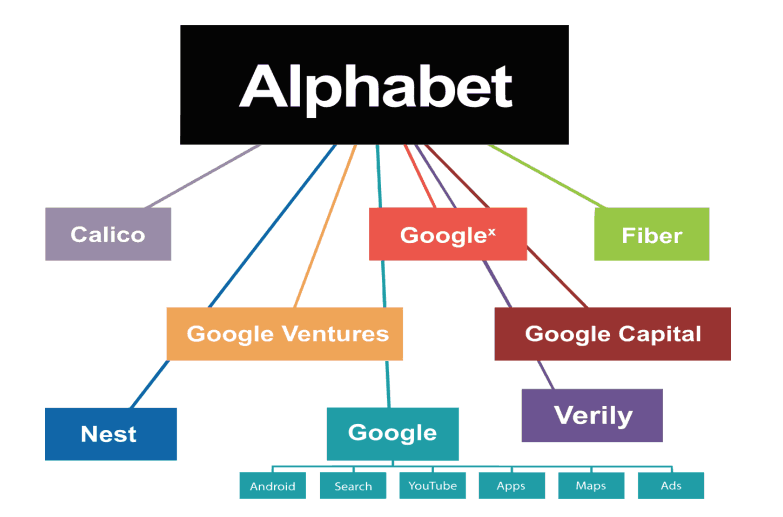

Alphabet

Alphabet is mostly a collection of companies. The largest of which, of course, is Google. This newer Google is a bit slimmed down, with the companies that are pretty far afield of our main internet products contained in Alphabet instead... Fundamentally, we believe this allows us more management scale, as we can run things independently that aren't very related.

Berkshire Hathaway - a Quintessential Holding Company

Berkshire Hathaway (the company that made Warren Buffet rich and famous) is possibly the most well-known example of a holding company structure. An overview of the company provides a good introduction to the financial mechanics of a Singapore holding company because it uses Singapore as a key jurisdiction in its holding company structure with many of its operational subsidiaries being based in the country.

The company is named after two cotton mills that were founded in the 19th Century, Berkshire Fine Spinning Associates and Hathaway Manufacturing Co. As the textile industry moved out of the United States to the developing world, the two companies merged in 1955. However, the fortunes of the combined company continued to decline. Warren Buffett started buying stocks in the company in early 1960s, and by 1965 he acquired control over it. Then in 1967, Buffet acquired an insurance company, National Indemnity, through Berkshire Hathaway and set it on course to become a giant holding company.

Key Benefits of a Singapore Holding Company

Loss Insulation

Holding companies are insulated from the losses of their subsidiaries, so a holding company isn't liable for acts of a subsidiary if the parent didn't actively participate in and have control over the actions of the subsidiary. However, there are exceptions for fraud and negligence).

Singapore's legal and tax regulatory framework provides full support for such loss insulation. Therefore, if a subsidiary company declares bankruptcy, its creditors cannot legally pursue the holding company. Thus, a Singapore holding company offers a very good loss insulation strategy. With such a structure, lines of business that have unique risk profiles can be segregated into a separate subsidiary.

For example, a fast food restaurant chain may own one subsidiary that owns the know-how patents, a second that owns real estate assets, a third that owns brand assets, and other subsidiaries that own and operate individual franchises. If there’s a fire in one of the franchise restaurants that injures customers, the brand and other assets of the business are protected from liability.

Additionally, if you set up the individual companies within your Singapore holding company correctly, the any debt liability of one subsidiary won't affect the other holding companies or the parent company.

Tax-Efficient Holding Company Structures

A Singapore holding company structure can help lower the overall tax bill of the business if individual subsidiaries are established with a goal of creating a tax-efficient holding company structure. Tax-efficient holding company structures can maximize tax reduction strategies by:

- Making use of double tax avoidance agreements (DTAAs) (such as the India-Singapore DTAA or the Malaysia-Singapore DTA) across jurisdictions

- Reducing or deferring the personal taxes of company owners

- Avoiding capital gain taxes

- Avoiding taxes on dividends, interests, and royalties (subject meeting conditions)

- Leveraging tax incentives by aligning subsidiary missions with incentives

- Using retained earnings across subsidiaries in a tax-optimized manner

Each individual subsidiary files its own tax returns, and the returns are consolidated at the level of the parent company. A properly-designed tax-efficient holding company structure can depress the overall tax liability of the holding company by locating each subsidiary in a jurisdiction that provides the most substantial tax benefits for its line of business.

Furthermore, the losses of one entity can be used to offset profits from another. The group may also use intra-group financing strategies. For instance, a company can lend the retained earnings of a profit-making subsidiary to another subsidiary that’s in growth mode to achieve better tax outcomes. On this front, Singapore provides a particularly suitable jurisdiction.

Thinking of Singapore?

Register

Easier. Faster. Better.

List of Tax Benefits Available in Singapore for Holding Companies

Single-tier corporate tax system

Tax exemption of foreign-sourced income

No capital gains tax

Tax incentives for IP holdings

Tax agreement benefits

Transfer pricing issues

Country-by-country reports

Singaporean Ultimate Parent Entities (UPE) of large multinational companies with a consolidated group revenue of S$ 1.125 billion or more also need to file a country-by-country report, which includes key information about revenue, tax paid and accrued, employment, capital, retained earnings, tangible assets, and business activities of the parent company and subsidiaries. All these regulations make Singapore a safe and advantageous location for setting up your tax-efficient holding company. However, it’s important to design the holding structure carefully so that it’s not seen as a tax avoidance scheme. There must be economic rationale and commercial reasons to justify the structure. Otherwise, the anti-avoidance regulations for transfer pricing, thin capitalization, and interest deductibility limitations may come into play. Inter-company transactions should be conducted at arm’s length and be properly documented and reported.

If you’d like professional support designing a Singapore holding company structure that’s both tax optimized and meets Singapore compliance requiremetns, contact us today. A good corporate services partner can help design your corporate structure for tax optimization and can ensure that it continues to meet the compliance obligations in Singapore.

No Limitations on the Domicile of Assets

Government Incentives

Favorable Accounting Regulations

Asset Protection

Asset Transactions

Intergenerational Asset Transfers

The parent company can also be used for succession planning purposes. Such a transfer can provide tax deferral while ensuring the whole estate easily transfers as a single unit to the next generation. Singapore's regulatory framework is particularly favorable for trust structures that include holding companies. A holding company provides the following advantages for intergenerational wealth transfers:

- Clear governance rules for family wealth can be established and consistently implemented

- Diverse assets that may reside in multiple countries can be transferred as a single unit

- Risk management, asset protection, and wealth preservation can be outsourced to professional manager through a single point of delegation

- A coherent intergenerational strategy can be developed that integrates asset holdings with other tools such as wills, family office, foundations, residence jurisdiction selection, and lasting power of attorney

Risk Reduction and Financing

Centralized and Consistent Control

Confidentiality

Considering Singapore?

Experienced team. Affordable cost. Online platform.

Holding Company Challenges

How to Set Up a Singapore Holding Company

Types of Holding Companies

There are only two types of holding companies in Singapore: investment and financial. Each has its own particular registration criteria, but there's not much difference in terms of taxation:

- An investment holding company is the default structure for companies operating outside the finance, banking, and insurance industries;

- A financial holding company is meant for owning subsidiaries operating in the finance, banking, and insurance industry.

Types of Corporate Structures

How a Holding Company Structure Works

Investing Through the Holding Company

How Profits Flow

Traditionally, when an operating company distributes profits, it pays dividends to its holding company. The holding company in turn may decide to distribute profits between individual shareholders. Otherwise, it can use it for other investments.

The key difference between owning shares directly versus through the holding company is the timing of when dividends and gains are taxed. By owning shares through the holding company, the entrepreneur has the flexibility to decide when to pay taxes. When investing through the holding company, one can choose to reinvest the untaxed funds of the holding company and achieve a higher return in the long term.

If a holding company wholly owns its subsidiaries, it may set requirements for how much money it must receive from the subsidiary. For example, a holding company may demand S$100 million in payments from its subsidiary every year, allowing the subsidiary to retain the rest for growth. Others may decide to take all of their subsidiaries’ excess cash.

Intercompany Loans

Traditionally, when an operating company distributes profits, it pays dividends to its holding company. The holding company in turn may decide to distribute profits between individual shareholders. Otherwise, it can use it for other investments.

The key difference between owning shares directly versus through the holding company is the timing of when dividends and gains are taxed. By owning shares through the holding company, the entrepreneur has the flexibility to decide when to pay taxes. When investing through the holding company, one can choose to reinvest the untaxed funds of the holding company and achieve a higher return in the long term.

If a holding company wholly owns its subsidiaries, it may set requirements for how much money it must receive from the subsidiary. For example, a holding company may demand S$100 million in payments from its subsidiary every year, allowing the subsidiary to retain the rest for growth. Others may decide to take all of their subsidiaries’ excess cash.

Tax savings

Structuring your investments through a Singapore-incorporated holding company provides great tax benefits. For example, consider a Japanese entrepreneur who’s investing in Japan under two scenarios:

- Scenario 1: The Japanese entrepreneur makes his or her investments directly in Japanese Company A

- Scenario 2: The Japanese entrepreneur routes the investments in Japanese Company A through Singapore holding Company B

When Company A distributes dividends to shareholders, tax liabilities differ significantly between the two scenarios. Let’s take a look at the tax liability.

Scenario 1 (S$) | Scenario 2 (S$) | |

Corporate taxable income amount | 100 000 000 | 100 000 000 |

Corporate income tax rate (23.2%) | 23 200 000 | 23 200 000 |

Distributable surplus | 76 800 000 | 76 800 000 |

Withholding tax on distributed dividends (20.42% for individual shareholders and 5% for Singapore corporate shareholders under the Singapore-Japan DTA) | 15 682 000 | 3 840 000 |

Surplus | 61 118 000 | 72 960 000 |

Tax on dividend income (0% for individual shareholder and 0% for Singapore corporate shareholder under the Foreign Sourced Income Exemption) | 0 | 0 |

Net amount in the hands of shareholders | 61 118 000 | 72 960 000 |

Is a Singapore Holding Company Appropriate for You?

Conclusion

If you decide to use a holding company structure, Singapore is one of the best jurisdictions. Its regulatory framework, tax policies, and legal system are favorable for such structures.

Select a corporate services partner firm in Singapore that will ensure that your structure is correctly designed to pass the economic substance test and will not face any objections from regulatory authorities.

A Singapore holding company can be established online in a couple of days with the help of a good service provider. You only need to supply the necessary information and required documents. Your service provider will take care of filing and submitting the application on your behalf.

How Can We Help?

Are you looking for company incorporation, immigration, accounting, tax filing or compliance services in Singapore? If so, CorporateServices.com can help.

With our deep experience in setting up holding companies, we can help you design the right structure for your business and asset holdings. You’ll get a customized solution tailored to your unique situation that delivers protection, privacy, risk mitigation, tax optimization, and operational efficiency. Please contact us if you need assistance registering a company in Singapore or if you’d like to transfer the administration of your existing company to us.

Related Articles

Considering Singapore?